Financial analysis: Another takeover bid in Malta

‘Interesting times once again for the local capital market’

In recent months I was highly critical about the state of the local capital market and also described it as moribund. However, the events over the past ten days brought back a level of excitement to the equity market that had not been evident in a very long time.

First, there was the confirmation early last week that the subsidiary of Hili Ventures Ltd, Marsamxett Properties Ltd, will be proceeding with a takeover bid of Tigné Mall plc after building up a stake of just under 50% over the past 11 months. This development may have been expected given the financial strength of the Hili Ventures Group and their wide portfolio of properties in various jurisdictions which are all fully owned.

However, the revelations of on September 11 across the banking sector were very much unexpected and created significant attention on the capital market with numerous posts across various parts of the media – both traditional media as well as social media channels. I do not feel it is correct to opine on the subject matter without having all details of the rumoured acquisition or merger of the two banks to enable me to comment accordingly.

Over the years, there were five previous takeover bids that took place across the local capital market. In some instances, namely in the cases of Crimsonwing plc, 6pm Holdings plc and Island Hotels Group Holdings plc, the final result was a full acquisition by each of the offerors and a subsequent delisting of the target company. In other instances, namely in the cases of FIMBank plc and GO plc, this merely resulted in the offeror acquiring additional shares and the target company remaining listed on the Malta Stock Exchange.

Marsamxett Properties Ltd acquired its initial stake in Tigné Mall plc on 9 October 2023, when it obtained a 12.81% holding in the company at a price of €0.82 per share. Almost one month later, Tigné Mall plc announced that Marsamxett Properties Ltd acquired a further 16.73% of the total shares in issue with the result that the subsidiary of Hili Ventures increased its stake to 31.63% of the company.

In line with the Capital Markets Rules, no further announcements of this nature took place which enabled the market to be aware of further acquisitions. However, the 2023 Annual Report of Tigné Mall plc published on April 22 indicated that as at December 31, 2023, Marsamxett Properties held 33.31% of the company which had then increased to 39.29% as at the date of the publication of the annual report in April 2024.

By then, therefore, Marsamxett Properties became the single largest shareholder of Tigné Mall plc surpassing MAPFRE MSV Life plc which still currently owns 35.46% of the issued share capital.

In the announcement published last Tuesday informing the market of the intention to launch a bid which was then formalised last Friday via the publication of the Offer Document, Marsamxett Properties Ltd confirmed that it currently holds 49.68% of the total issued share capital of Tigné Mall plc. Since April therefore, Marsamxett Properties acquired a further 14% of the company. Essentially, the free float (the amount of shares in public hands) of Tigné Mall plc has been reduced to just under 15% as a result of the various acquisitions that took place.

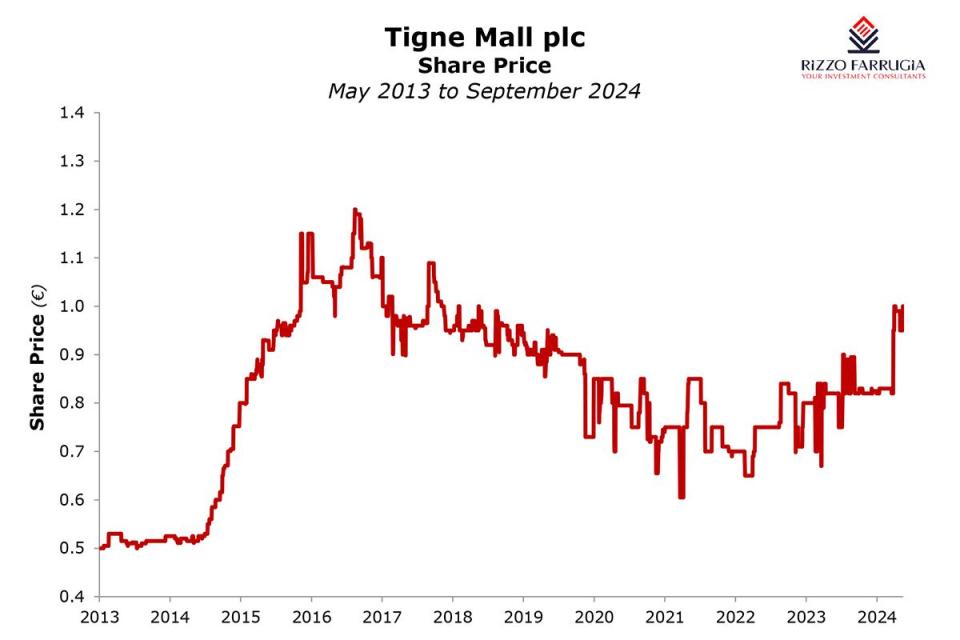

The offer available to all shareholders including MAPFRE MSV Life plc is of €1.04 per share. The share price of Tigné Mall plc has not traded at this level since February 2018. It had reached an all-time high of €1.20 in December 2016 at a time of the very low interest rate environment when many equities offering consistent dividends were being viewed as good alternatives to the low-yielding bonds on offer. At the start of the pandemic in early 2020, the share price of Tigné Mall plc was at around the €0.90 level and reached a low of €0.605 on July 19, 2021.

Hopefully, the government's planned initiatives in the upcoming Budget will also invigorate additional activity

More importantly, the offer by Marsamxett Properties Ltd of €1.04 per share is equivalent to a premium of 26.8%, compared to the €0.82 level which was the price at which Marsamxett Properties acquired most of its stake over the past 11 months.

The latest financial statements of Tigné Mall plc as at June 30, 2024, indicate that the Net Asset Value per share stood at €1.121. The price to net asset value or book value is a frequently-used metric across the commercial property sector. However, when analysing this offer by Marsamxett Properties in the context of the latest published net asset value, one must also take into consideration the two dividends received by shareholders since the end of June totalling €0.0289 per share representing both the final dividend in respect of the 2023 financial year and the interim dividend for 2024. As such, on an adjusted basis, the offer represents a 5% discount to the net asset value.

Commercial property companies listed on the local and international financial markets generally trade at a discount to the net asset value per share. For local investors, a review of the pricing multiples of some of the other commercial properties listed on the Malta Stock Exchange is possibly the best comparison in the context of the current offer of Tigné Mall plc.

Currently all companies trade at a discount to their stated net asset value and within this context it is worth highlighting those of Plaza Centres plc (49% discount), Malta Properties Company plc (40% discount) and Hili Properties plc (28% discount).

In some of my recent articles on the state of the local capital market, I mentioned the liquidity of the market and the sharp reduction in trading activity since the pandemic. This is an increasingly important consideration for the investing public who are becoming more appreciative of the need to quickly exit an investment if circumstances so require.

With two shareholders currently having 85% of the issued share capital of Tigné Mall plc, the shares in public hands (free float) is likely to decrease further in the coming weeks once the current takeover bid is concluded next month. As such, the investing public needs to be cognisant of the extremely limited trading activity that is very likely to characterise this particular equity following the conclusion of this takeover.

Given the challenging circumstances faced by investors in Maltese equities over recent years, it would be interesting to gauge the reaction to this latest takeover bid which could offer an exit route from a company owning a single asset in a sector which is becoming increasingly competitive.

In the near future, one cannot exclude other takeovers taking place across the Maltese capital market as a result of different shareholder profiles and requirements across various companies. These are interesting times once again for the local capital market.

Hopefully, the government's planned initiatives in the upcoming Budget will also invigorate additional activity beyond these latest corporate actions and also encourage other companies to list their equity to also replace the inevitable decline in the number of listings that take place via such takeover bids.

Rizzo, Farrugia & Co. (Stockbrokers) Limited is acting as manager, registrar, collecting and paying agent in connection with the Conditional Voluntary Public Takeover Offer.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd, ‘Rizzo Farrugia’, is a member of the Malta Stock Exchange and licensed by the Malta Financial Services Authority. This report has been prepared in accordance with legal requirements. It has not been disclosed to the company/s herein mentioned before its publication. It is based on public information only and is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. The author and other relevant persons may not trade in the securities to which this report relates (other than executing unsolicited client orders) until such time as the recipients of this report have had a reasonable opportunity to act thereon. Rizzo Farrugia, its directors, the author of this report, other employees or Rizzo Farrugia on behalf of its clients, have holdings in the securities herein mentioned and may at any time make purchases and/or sales in them as principal or agent, and may also have other business relationships with the company/s. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Neither Rizzo Farrugia, nor any of its directors or employees accept any liability for any loss or damage arising out of the use of all or any part thereof and no representation or warranty is provided in respect of the reliability of the information contained in this report.

© 2024 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved.