Financial analysis: MIA to propose share buyback

Board of directors will be making considerations regarding the optimisation of shareholder value over the coming year

Last Thursday, Malta International Airport plc held its customary press conference at the start of the year to disclose its traffic results for the previous year and also to provide guidance on the traffic expectations and financial targets for the current year.

Given the regular communication from the company on a monthly basis, with respect to traffic results as well as their upgrade in May 2024 to the traffic guidance for 2024, it was no surprise that MIA was heading for a very successful year with a new record of passenger movements.

In fact, shortly after the publication of the nine-month figures for the period from January to September 2024, I had published an article in October 2024 stating that following the 6.9 million in passenger movements during the first nine months (representing an increase of 15.5% from the level recorded in the same period last year), one can easily draw revised conclusions on the outcome for the year and comparing this to the most recent guidance published by the airport operator in May 2024 when the company said it expected passenger movements in 2024 of 8.45 million.

I had also opined that with an assumption of 10% growth in passengers during each of the last three months of the year compared to the same period in 2023, this would result in overall traffic of 8.9 million passengers in 2024.

Last week, MIA announced that during 2024, the airport experienced a 14.8% growth in passenger movements to a new record of 8.96 million with a seat load factor also at an annual all-time high of 86%.

During the press conference, MIA confirmed that the major growth in passengers came from Ryanair (Malta Air) as it achieved a 25% increase in passengers to 4.49 million with a market share of 50%. This is exactly in line with an interview in the media with Ryanair’s CEO in the fourth quarter of last year indicating that the airline will indeed be carrying 4.4 million passengers to and from Malta by the end of 2024.

Meanwhile, KM Malta Airlines experienced a 5% drop in passenger movements as its market share declined to 21%.

MIA is currently forecasting that overall passenger movements will amount to 9.3 million in 2025 which equates into a marginal increase of 3.8% over the 2024 level. Following such a remarkable upturn in passenger traffic during the past two years, it is to be expected that the double-digit growth cannot be expected to continue also in future years. To place this into perspective though, achieving 9.3 million passengers in 2025 would represent a 27.4% growth from the pre-COVID level of 7.3 million in 2019.

Based on the anticipation of 9.3 million passengers in 2025, MIA is expecting yet another record financial performance for this year. Last week, the company announced that revenues are expected to amount to €147 million (compared to the estimated figure of €141 million for 2024), Ebdita is anticipated at €91 million (2024 estimate of €85 million) with a projected net profit of €48 million (2024 estimate of €46 million).

While the actual traffic growth achieved in 2024 and the traffic and financial projections provided by the company is very valuable information to the market which surpasses the detail that is provided by most other companies in Malta, the main highlight for the investing public during last week’s press conference was the confirmation by the company that during its upcoming annual general meeting in May, it will be proposing a share buyback programme effective as from June 1, 2025.

This major initiative was confirmed via a company announcement on Thursday afternoon in which additional details on the proposed share buyback was also provided. MIA explained that it will be proposing a share buyback of 1.353 million shares (equivalent to 1% of the total issued share capital). Moreover, the company also explained that the proposal will include a minimum purchase price per share of €3 and a maximum of €7.38 and any shares repurchased will be cancelled and not held in Treasury for additional motives in the future.

Such an initiative may have been expected by the company during the course of this year following the clear remarks by the company during last year’s AGM held on May 15, 2024.

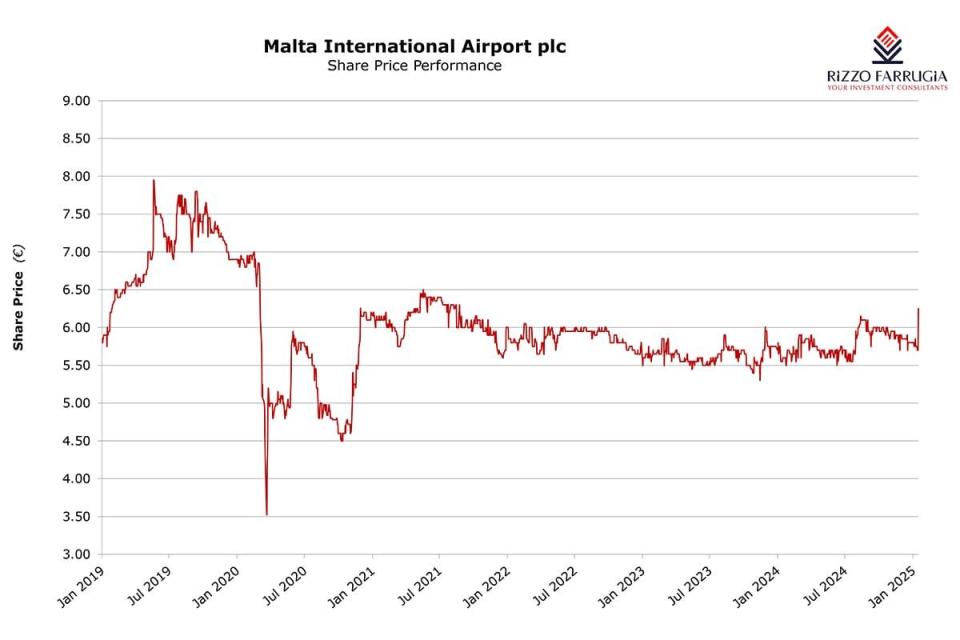

The chairperson had highlighted the “disparity between the company’s strong financial performance and share price recovery in 2023”.

Major growth in passengers came from Ryanair (Malta Air)

CEO Alan Borg had also promised during the same AGM that the board of directors will be making considerations regarding the optimisation of shareholder value over the coming year.

In last week’s announcement, MIA also explained that if the recommendation is approved at the forthcoming AGM, then the programme will run from June 1, 2025, up to the AGM of 2026. The company also clarified that its board of directors intends to seek annual approval for any extension of the programme at the AGM.

This important announcement was met very positively by the market. In fact, as trading commenced on Friday morning, the share price immediately climbed on very strong volumes. Last Friday, just over 157,0000 shares of MIA traded (for a value of over €930,000 which is high by local standards) with the share price closing up 9.6% at a three-year high of €6.25.

Hopefully, other companies in Malta will also consider such an initiative since it should lead to better activity across the Maltese equity market, which is fundamental to generate more positive sentiment following a prolonged period of very weak activity amid a general trend of declining share prices.

Bank of Valletta plc had also promised to conduct a study to optimise shareholder value. During the most recent meeting with financial analysts, the bank explained that the objectives of the study include an assessment of the financial and strategic rationale for a share buyback; improving the liquidity of BOV shares on the market and providing recommendations on the optimal implementation and timing of the programme. The market now awaits the outcome of the study and any decisions of any measures being implemented in due course.

A share buyback programme by BOV or other measures to improve liquidity in Malta’s largest capitalised company on the MSE could be another positive catalyst to instigate improved trading activity and renewed enthusiasm across the equity market.